The first step of budgeting is to make a budget. The main difference is you are actively putting cash into envelopes to start rather than categorization your transactions at a later date.

Online cash envelope system how to#

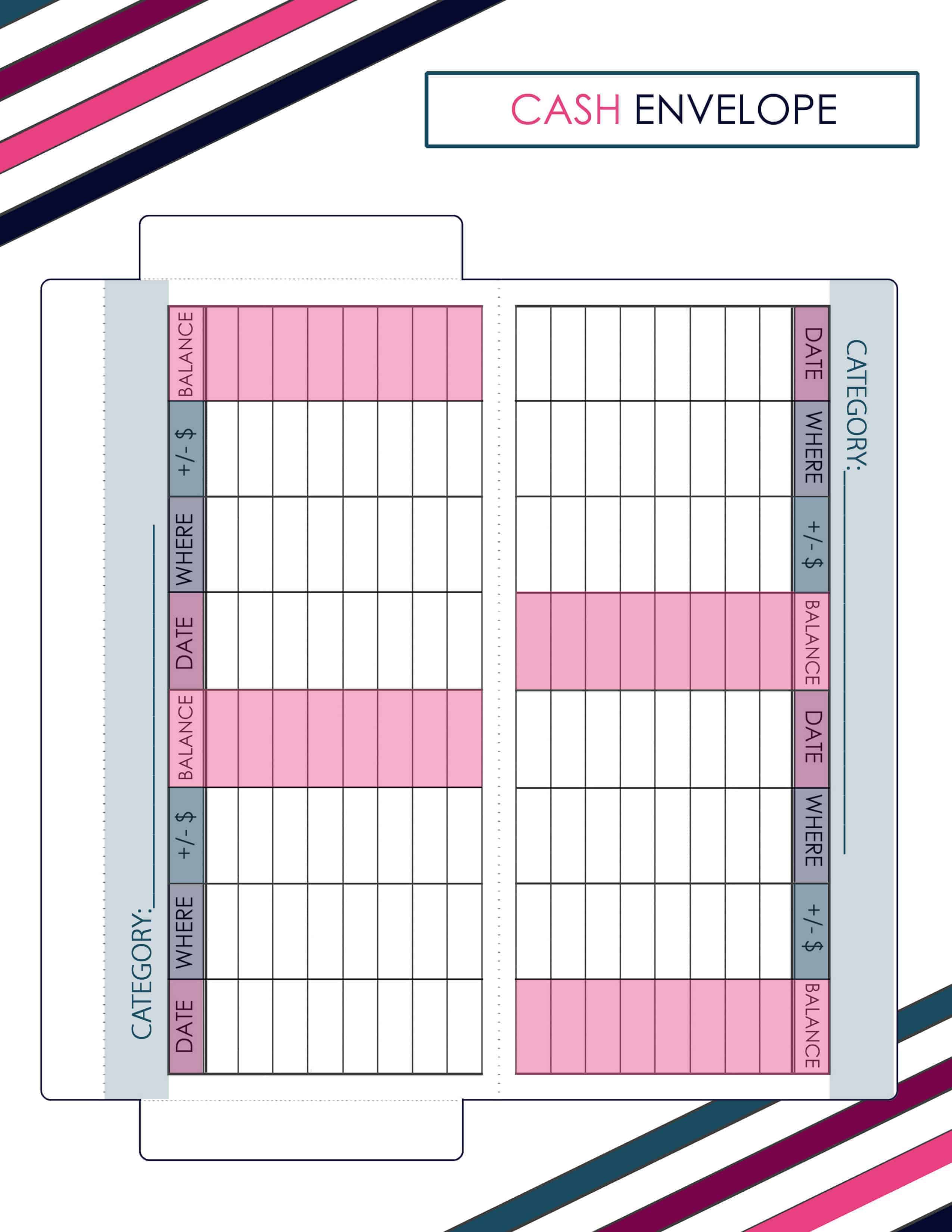

When using cash envelopes, the process you follow is similar to learning how to budget money. Let’s get started! Why Does the Cash Envelope System Work? He has helped many people overcome their debt and start living below their means. However, the cash envelope method has been made famous by Dave Ramsey. Learn how to organize your personal finances. In addition, it helps with breaking many bad spending habits, overcome debt, and start your path to financial freedom.Įven if you don’t use a money management system binder, I highly recommend having all of your bills, budget, and notes in one place. The bottom line… It is possible to budget using the cash envelopes. There are so many questions on how to budget with cash in our digital society. It is the most basic, simplest, and rudimentary way of managing money.īecause of how the online world of managing money, it is harder for us to grasp using the cash envelope method. It is how money has been handled for thousands of years. The method has been a long a really long time (remember credit cards, debit cards and even checks are relatively a new concept). Let’s explain this method of using cash envelopes for budgeting. Like the idea, but don’t use cash? Learn how to do this with the cashless envelope system as well. Let’s learn how to start using the cash envelope system properly. Online transactions are harder to track and more difficult to feel the pain of spending money. You get to see how and where you are physically spending your money. The cash envelope system is a great way to jump into budgeting for the first time. It will be explained in detail throughout this post. Over time, it will help you to stop living paycheck to paycheck and start saving more money.ĭon’t worry… we are going to cover how do you start the cash envelope system. Moving over to a cash envelope system is the simplest tool to start budgeting. It won’t be able to work properly and you won’t see the greatest benefits of using cash. If not, you are in the same game as before. While it is a game changer, you must learn how to use the cash envelope system correctly. IN CASH!įor many people, they can’t imagine ever spending money any other way than using the cash envelope system. It is the best way to only spend what you can actually afford. The cash envelope system can be a game changer for anyone struggling with money. As an Amazon Associate, I earn from qualifying purchases. For example, I set up my energy bill and council tax to come out of my ‘Home’ Space.This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. I also used the Bills Manager feature to connect specific direct debits to specific Spaces. I then topped up each Space with the amount I expected or aimed to spend and arranged automatic top ups for the beginning of each month. To put my budget into action, I created Spaces for my ‘Home’ (energy, council tax, WiFi, phone bill), ‘Car’ and ‘Dogs’. I live in the countryside so having a car is essential for me. I repeated this process to work out how much to allocate for fuel, which I noted in the ‘Transport’ section of the Budget Planner. I then divided this total by three to calculate a monthly average and rounded this figure up to account for prices increasing.

To work out a target for groceries, I used the Spending Insights section of the Starling app to look back over what I’d spent in the last three months.

I then entered how much I wanted to spend on groceries for myself and how much I could expect to spend on food and other necessities for my two dogs. (The figures and images below are illustrations, not actual figures or images from my bank account.) To kick off, I opened Starling’s Budget Planner and entered my monthly income and monthly bills, which include: This digital envelope system doesn’t involve physical cash and can include card payments, direct debits and standing orders. I can create multiple Spaces, for example for Subscriptions, Transport and Entertainment, and top them up with my target spending amount. Traditionally, this method involves separating physical cash into different envelopes to budget for different expenses.Īs a Starling customer, I can use Saving Spaces, the app feature that enables me to keep money separate from my main balance, to organise digital envelopes. The budgeting method I use is a digital version of the envelope method, also known as cash stuffing. In other words, now that groceries, fuel and energy are more expensive, I looked at my spending and created a new budget with more accurate spending targets using Starling’s Budget Planner. This month, I went back to school with my finances.

0 kommentar(er)

0 kommentar(er)